DocuClipper

Open Website-

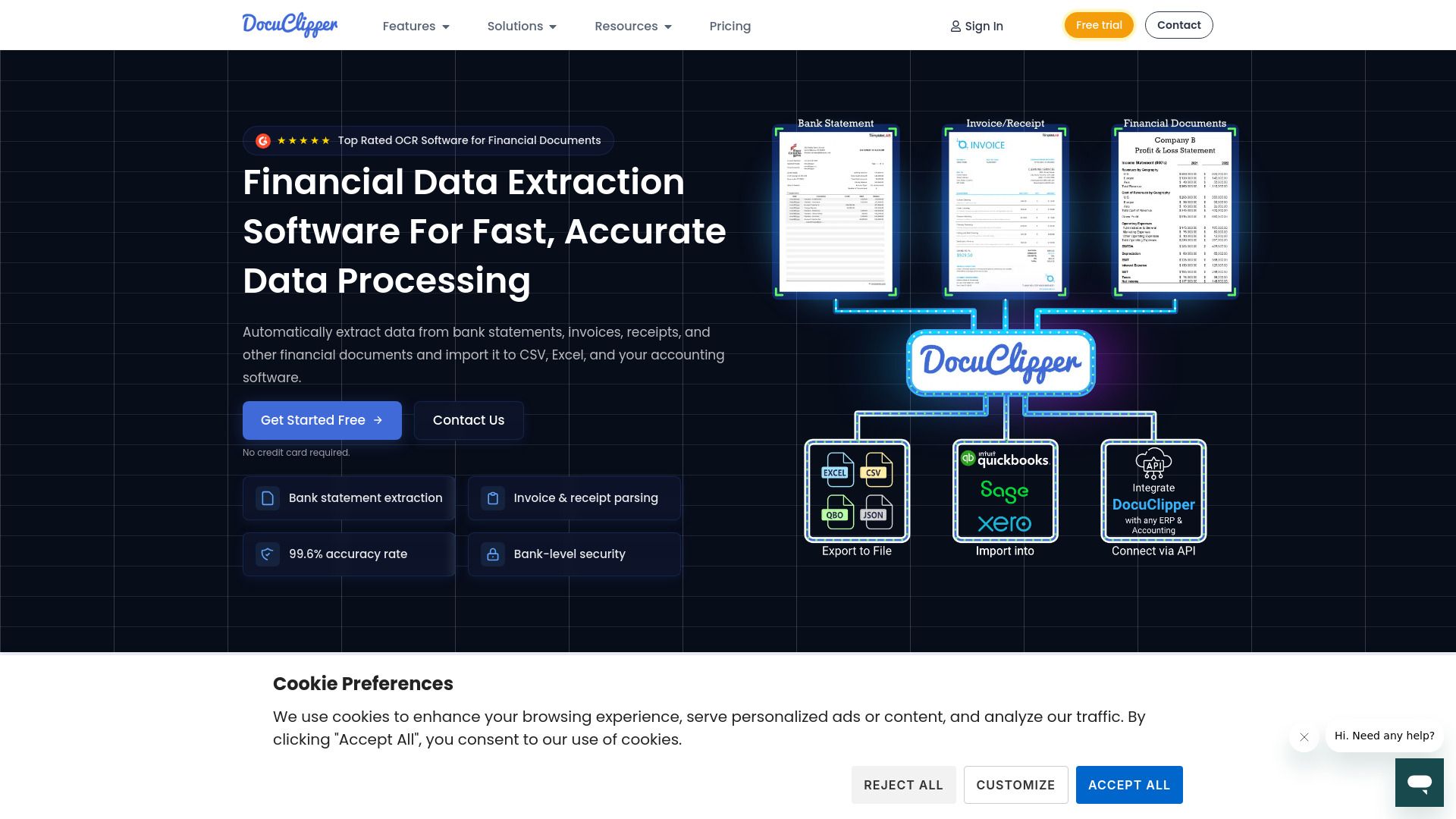

Tool Introduction:Extract bank data with 99.6% accuracy; export to Excel, CSV, QuickBooks.

-

Inclusion Date:Oct 28, 2025

-

Social Media & Email:

Tool Information

What is DocuClipper AI

DocuClipper AI is a financial data extraction platform that automates pulling structured data from bank statements, invoices, receipts, and other financial documents. Using OCR and purpose-built parsing, it delivers up to 99.6% accuracy, helping teams eliminate manual data entry and reduce reconciliation errors. Extracted transactions can be categorized and analyzed, then exported to Excel, CSV, or synced with accounting systems. With native integrations for QuickBooks, Xero, and Sage, plus APIs for custom workflows, DocuClipper streamlines finance operations end to end.

DocuClipper AI Key Features

- OCR data extraction: Accurately reads bank statements, invoices, and receipts to turn unstructured documents into clean, structured data.

- 99.6% accuracy: High recognition precision reduces manual corrections and minimizes bookkeeping and reconciliation errors.

- Transaction categorization: Automatically groups and labels transactions to speed up bookkeeping and reporting.

- Financial analysis: Summarizes cash flows and transaction patterns to support reviews, audits, and investigations.

- Exports to Excel and CSV: One-click export for spreadsheets or downstream tools, preserving column structure for analysis.

- Accounting software integrations: Direct connections to QuickBooks, Xero, and Sage for seamless posting and reconciliation.

- API access: Build custom integrations and automate ingestion and export within existing finance tech stacks.

- Multi-document support: Works across diverse financial documents, helping standardize data pipelines.

Who Should Use DocuClipper AI

DocuClipper AI is ideal for accountants, bookkeepers, business owners, financial investigators, family law professionals, and lenders who need reliable bank statement OCR, invoice extraction, and transaction categorization. It fits use cases such as client onboarding, month-end close, loan underwriting, forensic reviews, and legal discovery where fast, accurate financial data matters.

DocuClipper AI Usage Steps

- Sign in and create a new project for your financial documents.

- Upload bank statements, invoices, receipts, or other documents for OCR-based extraction.

- Select the document type and apply relevant parsing options if available.

- Run extraction to convert documents into structured transactions and line items.

- Review extracted fields and apply transaction categorization as needed.

- Run basic financial analysis to validate totals and identify anomalies.

- Export results to Excel or CSV, or sync with QuickBooks, Xero, or Sage.

- Use the API to automate repeatable workflows or integrate data with other systems.

DocuClipper AI Industry Use Cases

Accounting firms expedite client onboarding by extracting months of bank transactions in minutes and exporting them to Excel or posting to QuickBooks. Lenders validate applicant income and spending patterns directly from statements before underwriting. Financial investigators and auditors use categorized transactions to trace funds and detect irregular activity. Family law professionals analyze household cash flows and spending during settlements. Small businesses convert vendor invoices and receipts into structured data for faster reconciliation in Xero or Sage.

DocuClipper AI Pricing

For current plans, billing options, and any available trials, please refer to the official DocuClipper website. Pricing and feature tiers may vary by usage and integration needs.

DocuClipper AI Pros and Cons

Pros:

- High-accuracy OCR (up to 99.6%) reduces manual data entry and errors.

- Built-in transaction categorization speeds bookkeeping and reviews.

- Direct integrations with QuickBooks, Xero, and Sage simplify syncing.

- Flexible exports to Excel and CSV for analysis and archiving.

- API enables custom integrations and automated financial workflows.

- Supports multiple financial document types for consistent extraction.

Cons:

- OCR results may vary with poor-quality scans or unstandardized layouts.

- Automated categorization can require review for edge cases or compliance.

- API-driven automation may need developer resources to implement.

- Costs can depend on document volume and integration requirements.

DocuClipper AI FAQs

-

What types of documents does DocuClipper AI support?

It extracts data from bank statements, invoices, receipts, and other financial documents using OCR and financial parsing.

-

How accurate is the extraction?

DocuClipper reports up to 99.6% accuracy, reducing the need for manual corrections.

-

Which export formats are available?

You can export to Excel and CSV, or send data into connected accounting software.

-

What accounting platforms does it integrate with?

Native integrations include QuickBooks, Xero, and Sage for streamlined posting and reconciliation.

-

Is there an API for custom integrations?

Yes. DocuClipper provides APIs so teams can automate ingestion, processing, and export within their own systems.