- Home

- AI For Finance

- MoneyMade

MoneyMade

Open Website-

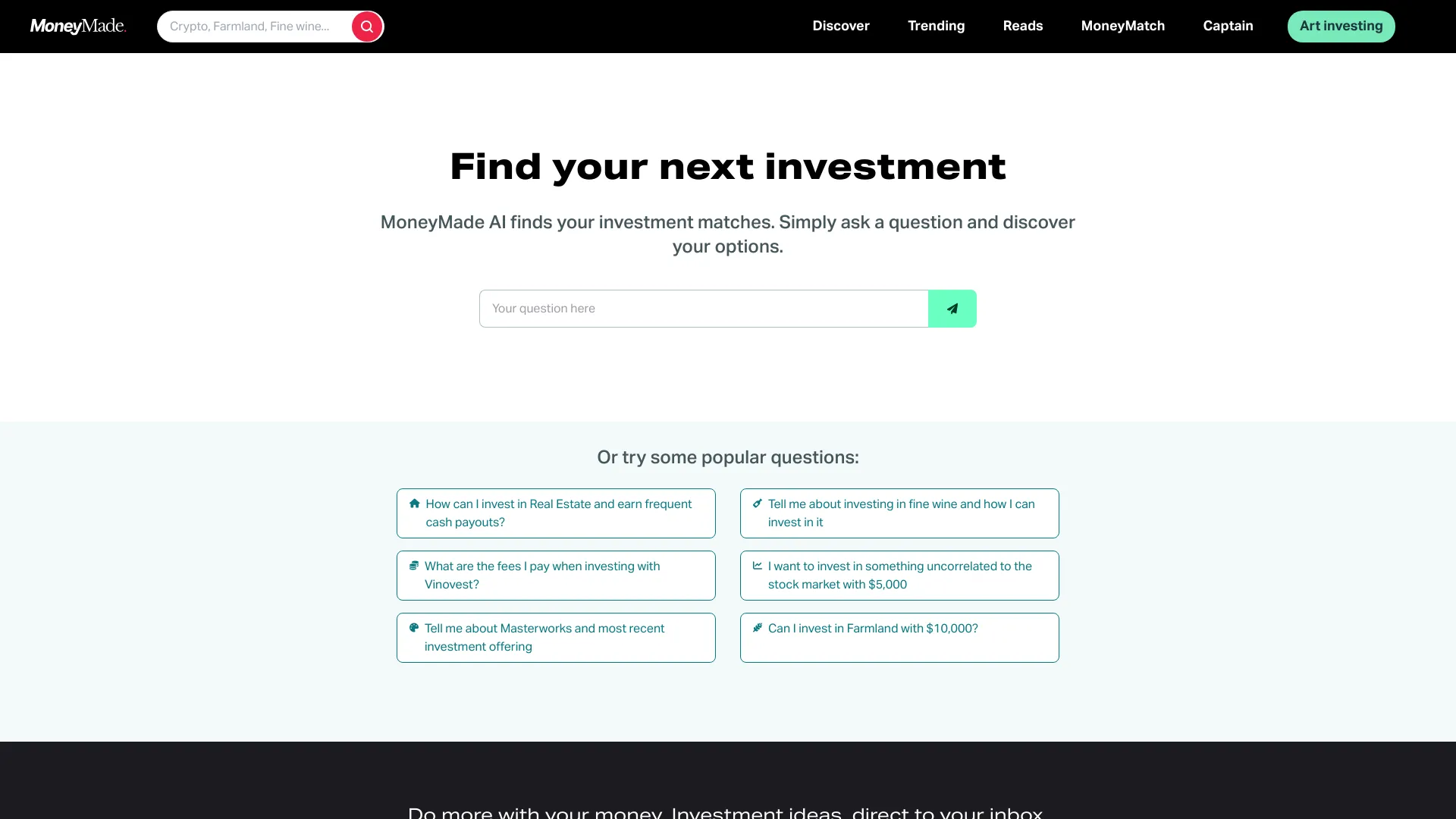

Tool Introduction:Find your investment match; compare platforms and alternative assets.

-

Inclusion Date:Nov 10, 2025

-

Social Media & Email:

Tool Information

What is MoneyMade AI

MoneyMade AI is an investment discovery assistant that helps you find platforms and products that fit your goals and risk profile. Ask a question in plain English—like how to invest in wine, art, farmland, crypto, real estate, or cash—and it surfaces curated options, comparisons, and key details such as fees, minimums, and liquidity. With editorial reviews, guides, and collections, it streamlines research so you can explore traditional and alternative investments with clarity before deciding where to open an account.

Main Features of MoneyMade AI

- Natural-language search: Ask investing questions in plain English and get relevant platforms, products, and resources.

- Personalized matches: Filter by risk tolerance, time horizon, account minimums, fees, and liquidity to refine recommendations.

- Alternative investments coverage: Discover options in wine, art, farmland, collectibles, crypto, and real estate alongside traditional assets.

- Platform comparisons: View side-by-side details like fee structures, minimum investments, asset access, and supported regions.

- Editorial reviews and guides: Read expert articles, platform reviews, and curated collections to support due diligence.

- Key facts at a glance: Summaries highlight strategy, risk factors, eligibility, and potential liquidity constraints.

- Save and revisit: Bookmark platforms or collections to organize research and return when you’re ready.

- Education-first approach: Clear explanations of asset classes, how they work, and what to consider before investing.

Who Can Use MoneyMade AI

MoneyMade AI suits individual investors who want a faster way to research investment platforms, especially those exploring alternative investments beyond stocks and ETFs. It helps beginners compare options without jargon, DIY investors evaluate fees and minimums, and experienced users scan niche opportunities like fractional art, wine funds, farmland, or private real estate. Content creators and researchers can also use its reviews and collections to inform audiences and support portfolio analysis.

How to Use MoneyMade AI

- Describe your goal in plain English (e.g., “ways to invest in farmland with low minimums”).

- Review the suggested platforms, products, and educational resources.

- Apply filters for risk level, fees, minimum investment, and liquidity to refine matches.

- Open platform pages to compare key details, pros and cons, and eligibility.

- Read articles, reviews, and collections to understand strategies and risks.

- Save your favorites to track options and revisit later.

- When ready, follow links to the provider’s site to open an account and complete onboarding.

- Continue learning with guides to support diversification and due diligence.

MoneyMade AI Use Cases

Retail investors use MoneyMade AI to compare robo-advisors or high-yield cash accounts, evaluate fee structures, and find low-minimum options. Alternative asset explorers identify platforms for wine investing, fractional art, or farmland leases and assess liquidity and risk. Real estate enthusiasts compare REITs and private real estate platforms. Crypto-curious users review exchanges and yield products, while researchers leverage reviews and collections to map the landscape before allocating capital.

MoneyMade AI Pricing

MoneyMade AI is generally available to browse at no cost. You can research platforms, read reviews, and explore collections without paying a subscription fee. Any account fees, minimums, or costs apply to the third-party investment platforms you choose to use. Always review pricing on the provider’s site before investing.

Pros and Cons of MoneyMade AI

Pros:

- Fast, natural-language investment discovery and filtering.

- Broad coverage of alternative investments alongside traditional assets.

- Transparent comparisons with fees, minimums, and liquidity highlights.

- Robust editorial content: reviews, guides, and curated collections.

- Helps streamline due diligence and shortlist platforms.

Cons:

- Information is for research purposes and not financial advice.

- Availability of platforms and products can vary by region and eligibility.

- Data may change; investors should verify fees and terms on provider sites.

- It is not a brokerage; account opening occurs on third-party platforms.

FAQs about MoneyMade AI

-

Is MoneyMade AI a financial advisor?

No. It provides educational content and discovery tools to support research, not personalized financial advice.

-

Does it cover alternative investments?

Yes. It surfaces options in wine, art, farmland, collectibles, crypto, and real estate in addition to traditional assets.

-

How are matches generated?

Matches are based on your queries and filters such as risk tolerance, minimums, fees, and liquidity preferences.

-

Do I open accounts through MoneyMade AI?

No. You research on MoneyMade AI, then open accounts directly with the selected third-party platforms.

-

Is there a cost to use MoneyMade AI?

Researching and browsing are typically free. Fees, if any, are charged by the investment platforms you choose.