- Home

- AI Accounting

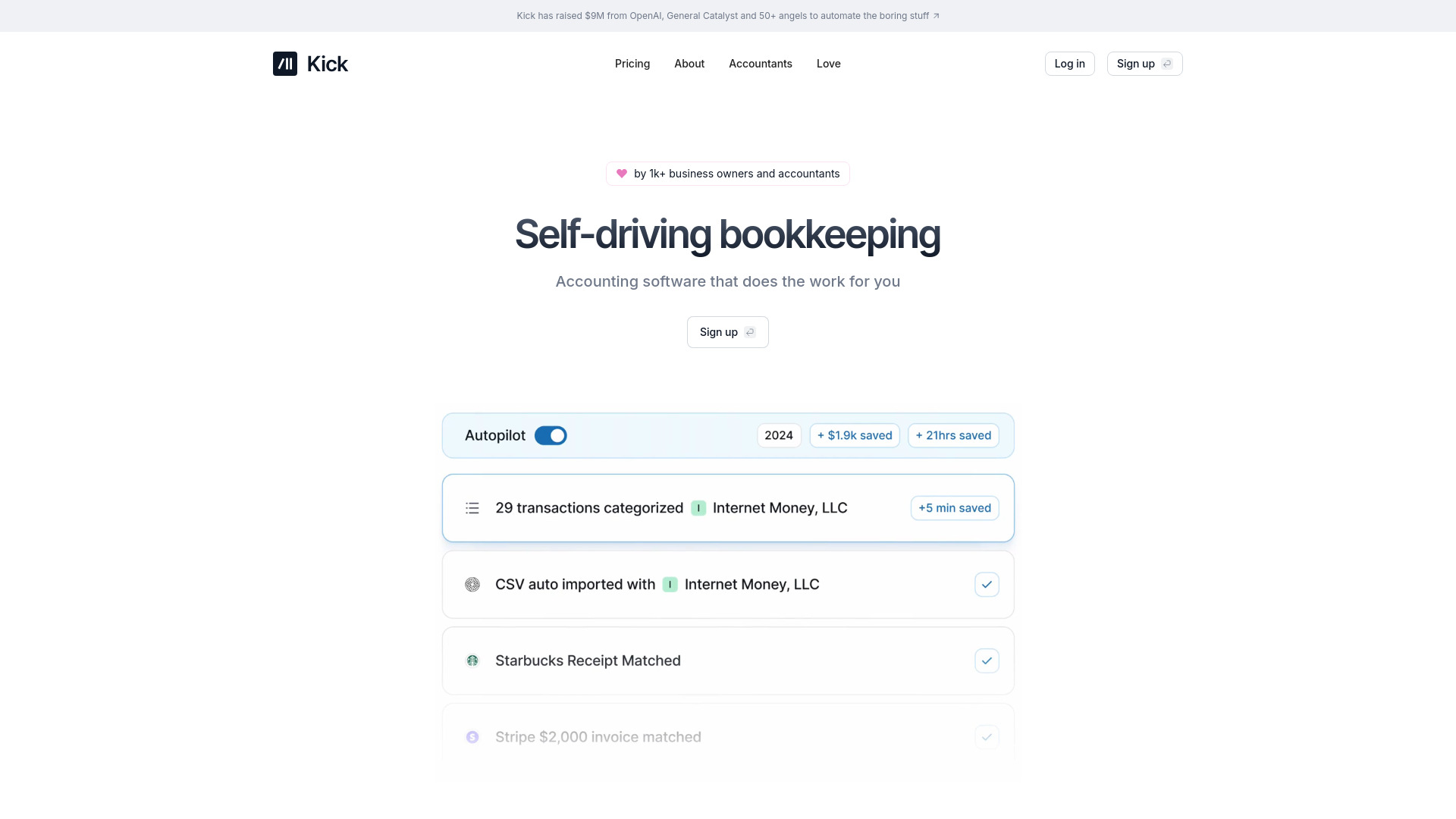

- Kick

Kick

Open Website-

Tool Introduction:Automated bookkeeping with auto‑categorization, deductions, multi‑entity.

-

Inclusion Date:Nov 06, 2025

-

Social Media & Email:

Tool Information

What is Kick AI

Kick AI is an AI-powered bookkeeping and accounting platform built for modern entrepreneurs, accountants, and small business teams. It connects to your financial accounts to automate data entry, auto-categorize transactions, spot tax deductions, and apply customizable rules that keep your books accurate in real time. With multi-entity support, revenue insights, and automated reconciliation, Kick AI helps reduce manual work, accelerate month-end close, and give you clear visibility into cash flow and performance so you can make faster, data-driven decisions.

Main Features of Kick AI

- Auto-categorization: Machine learning classifies income and expenses based on patterns, vendors, and your chart of accounts.

- Deduction identification: Flags likely write-offs to help maximize tax savings and maintain audit-friendly records.

- Customizable rules: Create if-this-then-that rules for recurring vendors, memos, or amounts to standardize coding at scale.

- Revenue insights: Track trends, margins, and channel performance with dashboards tailored for operators and accountants.

- Multi-entity support: Manage books for multiple businesses or clients in one workspace with consistent controls.

- Bank feeds and reconciliation: Securely connect accounts to sync transactions and streamline matching and month-end close.

- Exception review: Surface anomalies or uncategorized items so you focus only on what needs attention.

- Collaboration tools: Share access with your accountant or team and standardize workflows across entities.

Who Can Use Kick AI

Kick AI suits solo entrepreneurs, freelancers, and small business owners who want automated bookkeeping, as well as accountants, bookkeepers, and fractional CFOs managing multiple clients. it's helpful for e‑commerce sellers, agencies, consultants, SaaS startups, and real estate operators who need accurate expense tracking, revenue analysis, and multi-entity bookkeeping without heavy manual work.

How to Use Kick AI

- Sign up and create your workspace, adding one or more business entities.

- Connect bank, credit card, and payment processor accounts to sync transactions.

- Set up your chart of accounts and define custom rules for vendors, memos, and thresholds.

- Review the auto-categorized feed and confirm suggested tax deductions.

- Resolve exceptions, attach notes where needed, and reconcile statements.

- Monitor dashboards for revenue insights, cash flow, and spending trends.

- Invite your accountant or team to collaborate on reviews and month-end close.

Kick AI Use Cases

Agencies and consultants automate expense categorization and billable cost tracking. E‑commerce brands analyze revenue by channel and identify write-offs for shipping, software, and advertising. Real estate investors manage books across multiple entities in one place. Startups streamline monthly close, monitor runway, and prepare audit-ready records. Accounting firms use rule-based automation to scale client bookkeeping while maintaining consistency and quality.

Pros and Cons of Kick AI

Pros:

- Significant time savings through automated categorization and rules.

- Consistent books across clients or subsidiaries with multi-entity support.

- Built-in deduction identification to improve year-end tax readiness.

- Actionable revenue and cash flow insights for smarter decisions.

- Collaboration features for operators, bookkeepers, and accountants.

Cons:

- AI categorization may require periodic review and adjustments.

- Initial rule setup and chart-of-accounts mapping can take time.

- Bank feed availability and stability can vary by institution.

- Advanced workflows may require training for new users.

FAQs about Kick AI

-

Is Kick AI a replacement for my accountant?

No. Kick AI automates bookkeeping and categorization, while accountants provide advisory services, compliance guidance, and reviews.

-

How does Kick AI identify tax deductions?

It uses patterns in vendors, categories, and transaction context to flag likely deductible expenses for your review and confirmation.

-

Can I manage multiple businesses or clients?

Yes. Multi-entity support lets you handle separate books in one workspace with shared controls and reporting.

-

Do I retain control over categories and rules?

Absolutely. You can customize the chart of accounts, create rules, and override AI suggestions at any time.

-

Is my financial data secure?

Kick AI uses secure bank connections and encryption to protect data in transit and at rest, following industry best practices.