- Home

- AI Accounting

- Accountable

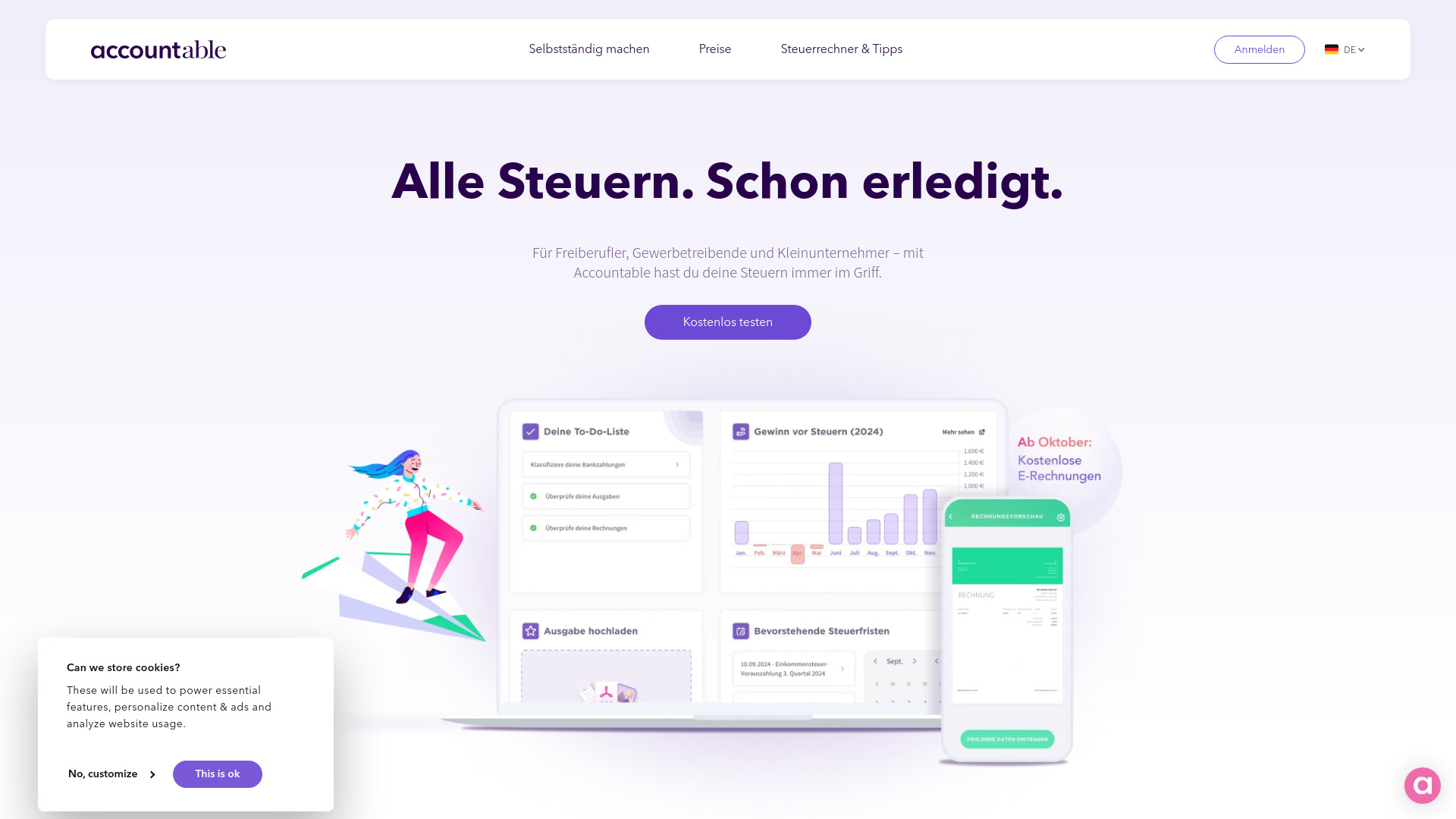

Accountable

Open Website-

Tool Introduction:Freelancers in Germany: file taxes fast, invoicing, expenses, AI help.

-

Inclusion Date:Oct 28, 2025

-

Social Media & Email:

Tool Information

What is Accountable AI

Accountable AI is a tax and accounting solution for freelancers and self‑employed professionals in Germany. It unifies invoicing, expense capture, and secure bank connections with an AI tax advisor that explains regulations, flags deductible expenses, and estimates VAT and income tax in real time. With automated categorization, receipt storage, and deadline reminders, it streamlines bookkeeping and helps you prepare and submit required tax obligations with only a few clicks. The result is clearer cash flow, fewer errors, and compliant documents ready for your filings or accountant.

Accountable AI Key Features

- Smart invoicing: Create compliant invoices with correct customer details, VAT rates, and payment terms; track status and send reminders.

- Expense tracking: Capture receipts, auto-categorize purchases, and store proof for audits and deductions.

- Bank integration: Connect business accounts to reconcile income and expenses and keep books up to date.

- AI tax advisor (KI Steuerberater): Get plain‑English guidance on German tax rules, forms, and thresholds with contextual tips.

- Real‑time tax estimates: See projected VAT and income tax liabilities as transactions land to avoid surprises.

- Compliance workflow: Generate summaries and exports for filings or to share with a human tax advisor.

- Reminders and alerts: Stay on top of deadlines, missing receipts, and anomalies that could affect returns.

Who Should Use Accountable AI

Ideal for freelancers, solo entrepreneurs, contractors, and creators operating in Germany who need simple, reliable bookkeeping and tax support. It suits consultants, designers, developers, photographers, and other self‑employed professionals who issue invoices, manage expenses, and prepare VAT and annual income tax. It is also helpful for newcomers or expats seeking clear explanations of German tax workflows.

How to Use Accountable AI

- Create an account and set up your profile, including business details, tax numbers, and VAT status.

- Connect your bank accounts to sync transactions and enable automatic categorization.

- Configure invoice templates, payment terms, and customer lists; start issuing invoices.

- Record expenses by uploading receipts; let the system extract data and assign categories.

- Open the AI tax advisor to ask questions, review recommendations, and understand obligations.

- Monitor the tax dashboard for real‑time VAT and income tax estimates and upcoming deadlines.

- Generate required summaries and exports; submit filings where supported or share with your tax advisor.

Accountable AI Industry Use Cases

A freelance designer uses Accountable AI to issue VAT‑compliant invoices, auto‑reconcile incoming payments, and prepare periodic VAT returns. A software contractor tracks travel and SaaS expenses with receipt capture, while the AI advisor clarifies what is deductible. A content creator consolidates multiple income sources via bank feeds, monitors tax estimates through the year, and exports a year‑end package for their accountant.

Accountable AI Pricing

Accountable AI is offered on a paid subscription basis with feature‑based tiers. Availability of free trials, discounts, and specific plan limits can vary. For the latest pricing, included features, and regional availability, refer to the official website or in‑app billing page.

Accountable AI Pros and Cons

Pros:

- Localized for German freelancers with VAT and income tax workflows.

- Integrated invoicing, expenses, and bank data reduce manual bookkeeping.

- AI tax guidance improves clarity on rules and deductions.

- Real‑time estimates and reminders help prevent missed deadlines.

- Clean exports for collaboration with a human tax advisor.

Cons:

- Focus on Germany may limit usefulness for businesses outside this jurisdiction.

- Submission options and integrations can vary by region and bank.

- AI explanations are guidance only and do not replace professional advice.

- Requires careful setup of categories and VAT settings for best accuracy.

Accountable AI FAQs

-

Does Accountable AI work if I’m not based in Germany?

Its strengths are tailored to German freelancer tax needs. If you operate elsewhere, confirm local support before adopting it.

-

Can the AI tax advisor replace a human Steuerberater?

No. It provides guidance and explanations but is not a substitute for licensed professional advice, especially for complex cases.

-

Does it handle VAT (USt) returns?

It helps prepare VAT calculations and documentation and can assist with submission where supported. Check the app for the exact process available to you.

-

Can I export data for my accountant?

Yes. You can generate reports and exports (e.g., summaries, CSV/PDF) to share with your accountant for filing and review.

-

How does bank integration impact security?

Bank connections are read‑only and intended for reconciliation and categorization. Review the provider’s security documentation for details before connecting accounts.