- Home

- AI For Finance

- Inven

Inven

Open Website-

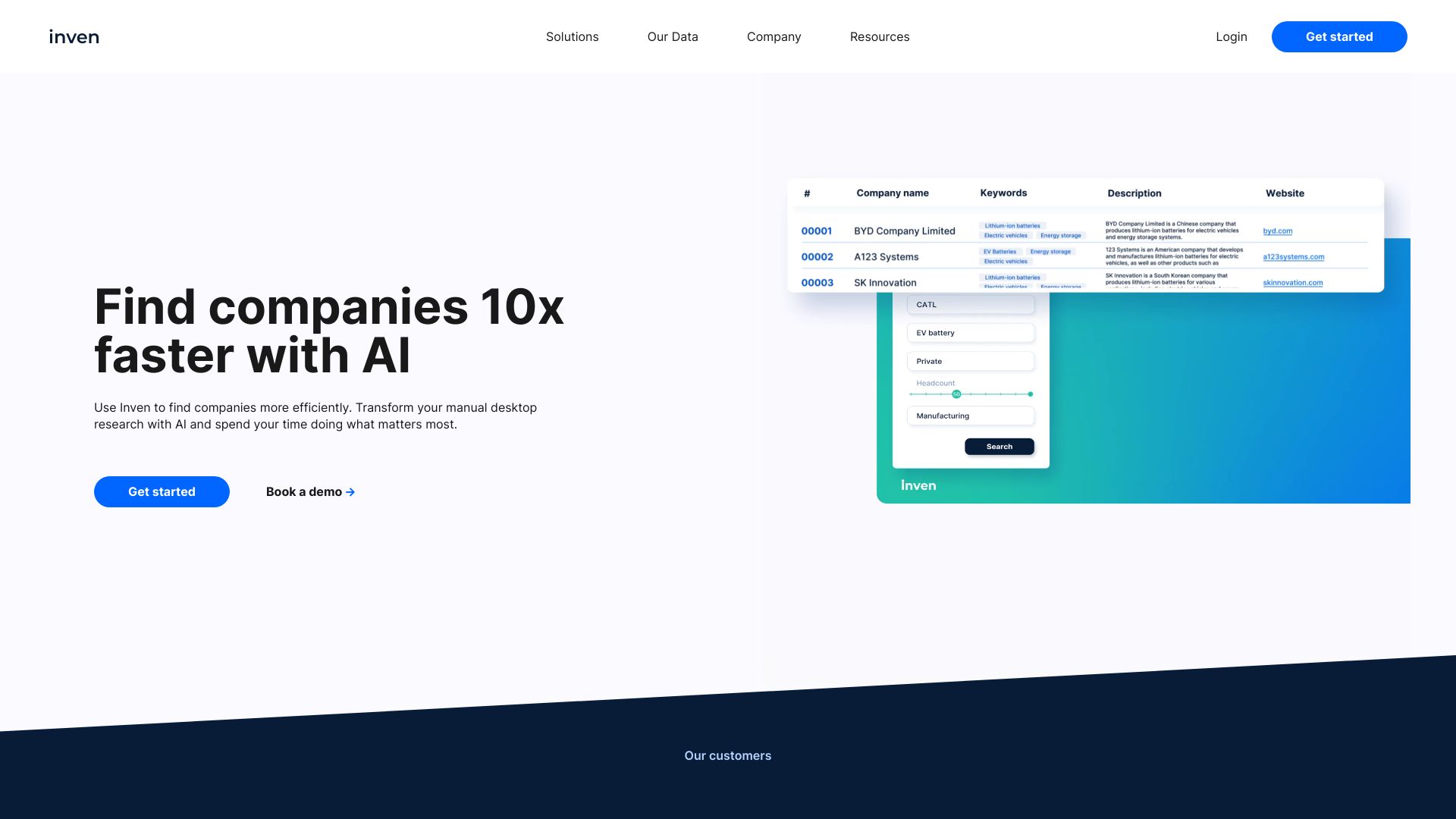

Tool Introduction:AI deal-sourcing for PE/VC: surface M&A targets and comps 10x faster

-

Inclusion Date:Oct 28, 2025

-

Social Media & Email:

Tool Information

What is Inven AI

Inven AI is an AI-powered deal-sourcing platform that helps private equity, venture capital, search funds, corporate development teams, investment banks, consultants, and business brokers find M&A targets and high-potential companies faster. It scans millions of websites and public signals to surface companies that match specific investment or acquisition criteria, from industry and geography to size and growth indicators. By combining web-scale company intelligence with similarity-based search, Inven AI accelerates target discovery, investor and buyer identification, and access to private market deal data.

Inven AI Main Features

- AI-driven similarity search: Discover companies that closely match an ideal profile or thesis using multi-factor criteria such as industry, geography, size, growth, and technology focus.

- Web-scale data aggregation: Continuously scans millions of websites, corporate pages, and public signals to build comprehensive firmographic and market context for private companies.

- Advanced filtering: Refine results by sector, location, employee count, funding stage, and other deal-relevant attributes to pinpoint the most relevant targets.

- Investor and buyer mapping: Identify potential investors and strategic buyers related to your thesis to expand buyer lists or fundraising outreach.

- Private market deal insights: Access public information on acquisitions, funding rounds, and related events to understand traction and momentum.

- Target list curation: Organize candidates into prioritized lists to streamline team review and due diligence workflows.

- Global coverage: Surface cross-border opportunities and comparable companies beyond traditional databases.

Who Is Inven AI For

Inven AI is designed for professionals involved in M&A target sourcing and deal origination, including private equity and venture capital investors, search fund entrepreneurs, corporate development teams, investment bankers, management consultants, and business brokers. It also supports analysts and associates who need to rapidly map markets, discover lookalike companies, and build investor or buyer lists for live mandates.

How to Use Inven AI

- Define your thesis: clarify sector, business model, geography, size, and strategic fit requirements.

- Set search criteria: input keywords and filters (industry, location, headcount, funding stage, growth indicators).

- Run similarity search: use Inven AI to find companies that resemble your ideal profile or selected exemplars.

- Review profiles: assess firmographics, public signals, and private market deal data to gauge relevance.

- Refine and narrow: adjust filters, exclude outliers, and focus on the strongest strategic fits.

- Build shortlists: add top candidates to curated lists for internal review and prioritization.

- Map ecosystem: identify potential investors or buyers connected to the space to support outreach.

Inven AI Industry Use Cases

A private equity firm pursuing a buy-and-build strategy uses Inven AI to map niche B2B software vendors across Europe, ranking targets by size and growth signals. A venture fund identifies emerging climate tech startups that resemble recent winners to expand its pipeline. A corporate development team scans for acqui-hire opportunities in applied AI, filtering by headcount and tech focus. An investment bank builds comprehensive buyer and investor lists for a sell-side mandate in healthcare services.

Inven AI Pricing

For the most accurate and current pricing information, visit the official Inven AI website or contact the sales team to request a demo and a tailored quote.

Inven AI Pros and Cons

Pros:

- Speed and scale: Surfaces relevant M&A targets and high-potential companies significantly faster than manual research.

- Broad coverage: Web-scale scanning captures private company signals that traditional databases may miss.

- Similarity-based discovery: Finds lookalike companies aligned with a precise investment thesis.

- Deal context: Incorporates public private-market activity to inform prioritization.

- Multi-use-case utility: Supports target sourcing, buyer/investor identification, and market mapping.

Cons:

- Data validation needed: Web-derived signals can be noisy; human diligence remains essential.

- Limited private financials: Availability of revenue or margin data may be sparse versus proprietary databases.

- Coverage variance: Depth can vary by region, niche, or language, requiring iterative refinement.

- Learning curve: Optimal results depend on well-defined criteria and careful filter tuning.

Inven AI FAQs

-

What data sources does Inven AI use?

It aggregates publicly available web data and signals from millions of sites, combining them to build company profiles and market context.

-

Can Inven AI replace traditional deal databases?

It complements traditional databases by expanding private company coverage and speeding discovery, but formal diligence should use multiple sources.

-

How accurate are company profiles?

Accuracy depends on public web signals. Use Inven AI for discovery and prioritization, then verify details directly with companies or trusted datasets.

-

Does it support global searches?

Yes, Inven AI is designed to surface cross-border opportunities and comparable companies across regions.

-

What types of teams benefit most?

PE/VC firms, search funds, corporate development, investment banking, consulting, and business brokerage teams that need faster, broader target sourcing.