- Home

- AI For Finance

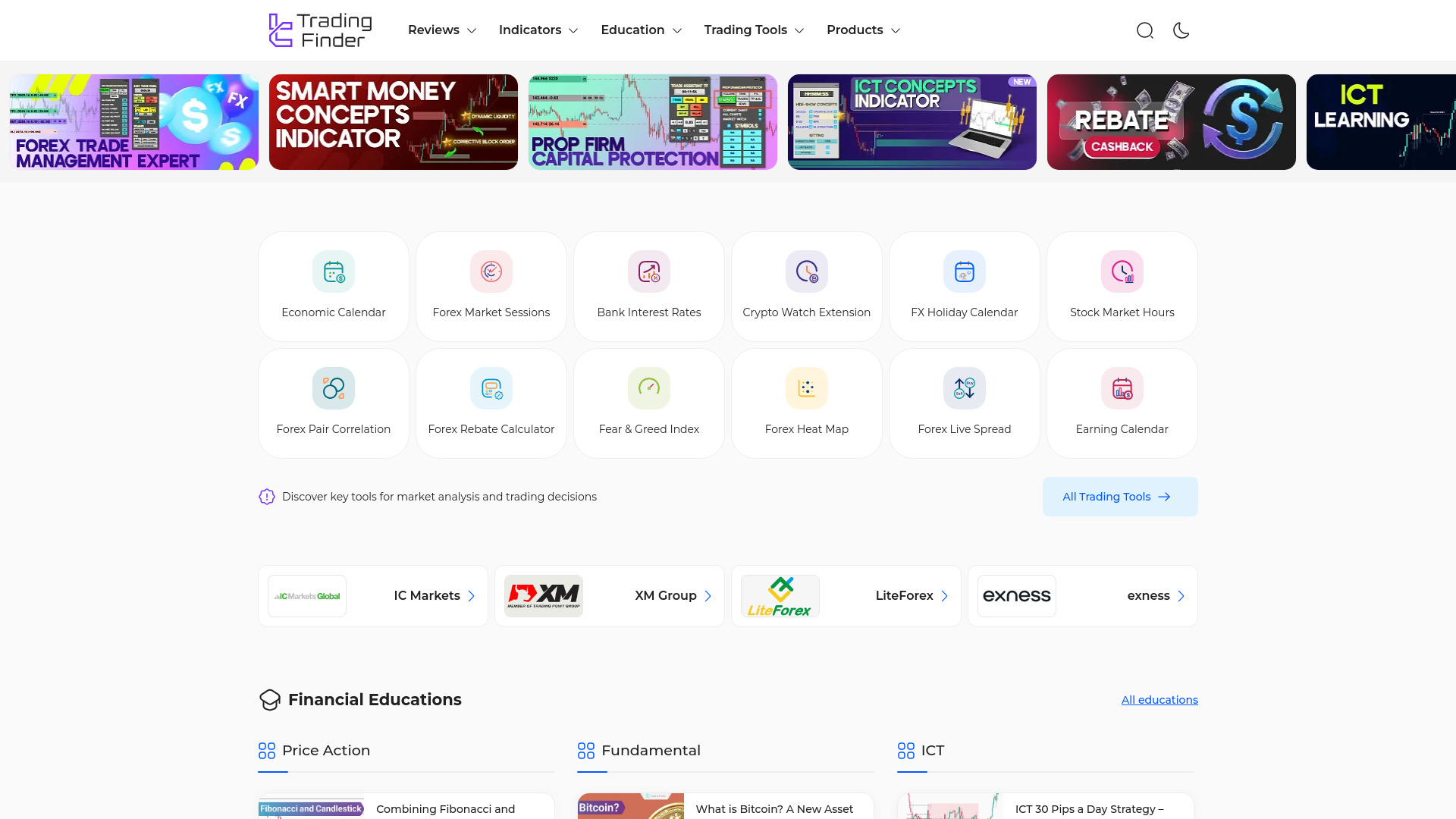

- TradingFinder

TradingFinder

Open Website-

Tool Introduction:AI SMC indicators for MT4/MT5 & TradingView; order flow and risk.

-

Inclusion Date:Oct 21, 2025

-

Social Media & Email:

Tool Information

What is TradingFinder AI

TradingFinder AI (operating as TFLab on TradingView) is a cross-platform suite of AI-driven trading indicators and automation for TradingView, MT4/MT5, and NinjaTrader. It blends institutional-grade Smart Money Concepts with order flow analytics, liquidity detection, and market structure identification, powered by machine learning models trained on 10+ years of market data. Built for forex, stocks, indices, and crypto, it delivers regime detection, AI-based risk management, and professional backtesting to enhance entries, exits, and position sizing for scalpers and swing traders alike.

TradingFinder AI Main Features

- Smart Money Concepts (SMC): Automated structure breaks, supply/demand zones, and premium/discount mapping to align with institutional order flow.

- Order Flow Suite: Volume, delta, and imbalance tools to read absorption, aggression, and liquidity sweeps in real time.

- Liquidity Scanner: Detects resting liquidity pools, equal highs/lows, and stop clusters to anticipate potential price magnets.

- AI Trend Predictor: Machine learning forecasts trained on multi-year, multi-asset data to gauge directional bias and trend strength.

- Smart Money EA (MT4/MT5): Strategy automation with AI-guided entries, exits, and management for consistent execution.

- Multi-timeframe Regime Detection: Identifies trending, ranging, and transitional phases to adapt strategies to market conditions.

- AI Risk Management: Dynamic position sizing, volatility-aware stops, and target optimization for risk-adjusted performance.

- Professional Backtesting: Robust parameter testing and walk-forward validation to reduce overfitting and improve reliability.

- Cross-Platform Integration: Unified workflows for TradingView, MT4/MT5, and NinjaTrader to suit different trading stacks.

- Continuous Updates & Support: Active development and expert assistance tailored to prop and institutional use.

Who Should Use TradingFinder AI

Ideal for professional and advanced retail traders in forex, stocks, indices, and crypto who rely on SMC, order flow, and quantitative signals. Prop firm candidates, hedge fund desks, systematic traders, and discretionary scalpers/swing traders benefit from AI-enhanced bias, disciplined risk controls, and platform flexibility.

How to Use TradingFinder AI

- Choose your platform: TradingView, MT4/MT5, or NinjaTrader, and install the relevant indicators, EA, or suites.

- Load core tools (e.g., SMC, Liquidity Scanner, Order Flow Suite) on your preferred symbols and timeframes.

- Run regime detection to determine trending vs. ranging conditions and select a matching playbook.

- Use the AI Trend Predictor to confirm directional bias and refine high-probability zones.

- Map liquidity pools and order flow signals to plan entries, stops, and targets with confluence.

- Enable AI risk management for position sizing and volatility-aware stop/target placement.

- Backtest and forward test configurations; iterate parameters to reduce overfitting.

- Automate with the Smart Money EA (if on MT4/MT5) or execute discretionary trades with alerts.

TradingFinder AI Industry Use Cases

Prop trading teams deploy the Order Flow Suite and SMC tools to standardize setups across desks. Hedge funds use the AI Trend Predictor and regime detection to filter signals and size positions across multi-asset portfolios. Retail algorithmic traders leverage the Smart Money EA for rules-based execution on MT4/MT5, while discretionary crypto traders apply the Liquidity Scanner to anticipate stop runs and liquidity grabs around key levels.

TradingFinder AI Pros and Cons

Pros:

- Institutional-grade SMC, order flow, and liquidity mapping integrated with AI analytics.

- Cross-platform support for TradingView, MT4/MT5, and NinjaTrader.

- Models trained on 10+ years of data with tools for regime adaptation.

- Strong risk management and professional backtesting workflows.

- Suitable for both discretionary and automated trading styles.

Cons:

- Learning curve for users new to SMC, order flow, or systematic testing.

- Performance can vary across assets and market regimes; requires ongoing validation.

- Automation and multi-platform setups may need careful configuration and maintenance.

TradingFinder AI FAQs

-

Does TradingFinder AI work for scalping and swing trading?

Yes. Multi-timeframe regime detection and AI bias help align scalps, intraday trades, and swing positions with prevailing conditions.

-

Which markets are supported?

Forex, stocks, indices, and crypto are supported across TradingView, MT4/MT5, and NinjaTrader, subject to your data/feed access.

-

Can I automate strategies?

On MT4/MT5, the Smart Money EA enables automation. On TradingView and NinjaTrader, you can combine indicators with alerts or platform-native automation.

-

How do I reduce overfitting?

Use out-of-sample testing, walk-forward analysis, and risk constraints. Validate across assets and regimes before scaling position size.