- Home

- AI For Finance

- ArbitrageScanner

ArbitrageScanner

Open Website-

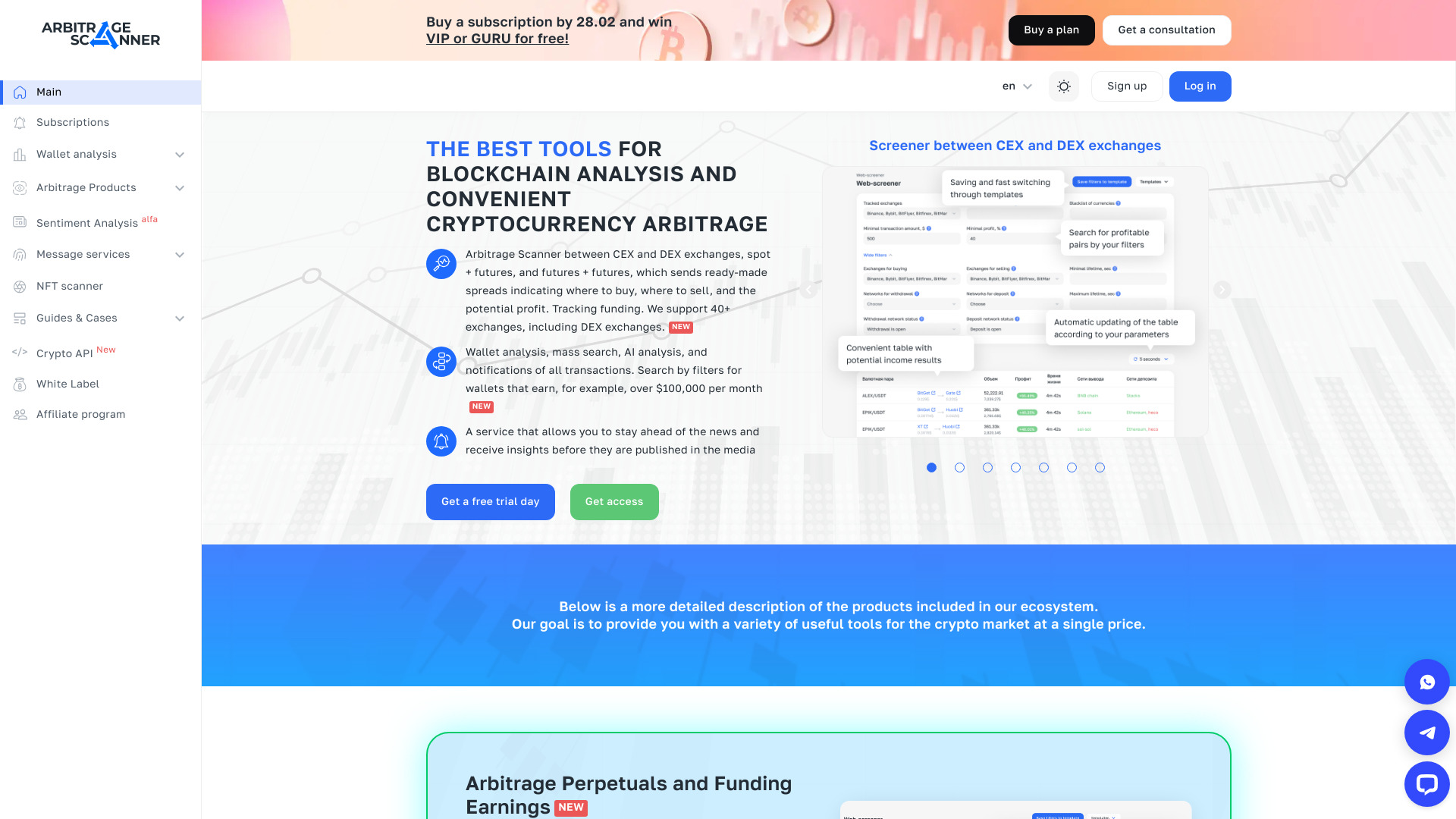

Tool Introduction:Crypto arbitrage, on-chain and sentiment tools with bots & API.

-

Inclusion Date:Nov 01, 2025

-

Social Media & Email:

Tool Information

What is ArbitrageScanner AI

ArbitrageScanner AI is a crypto analysis ecosystem from ArbitrageScanner.io that unifies arbitrage scanning, market sentiment analysis, and on-chain wallet intelligence in one place. Serving both individuals and businesses, it delivers insights via a web dashboard, Telegram bots, and B2B API access with license options that carry no maintenance costs. With support for centralized and decentralized exchanges, the platform helps traders identify price discrepancies, track wallet flows, and gauge market mood in real time. Cloud-based bots, educational materials, and a private client chat round out a toolkit designed to streamline crypto research and decision-making.

Main Features of ArbitrageScanner AI

- Cross-exchange arbitrage scanner: Spot price spreads across CEX and DEX venues, apply filters, and monitor potential opportunities in real time.

- On-chain wallet analysis: Track notable addresses, token movements, and portfolio changes to uncover trends and whale behavior.

- Sentiment analytics: Measure market mood and trending narratives to complement technical and on-chain signals.

- Telegram bots and alerts: Personalized, cloud-hosted bots deliver 24/7 monitoring with configurable notifications.

- API and B2B licensing: Integrate signals and data into proprietary systems via API; software licenses come with no ongoing maintenance costs.

- DEX and CEX coverage: Monitor pairs and pools across multiple exchanges to assess liquidity and slippage risks.

- Custom filters and watchlists: Create focused views by exchanges, pairs, tokens, or addresses for faster research.

- Education and community: Access learning materials and a private client chat for best practices and support.

Who Can Use ArbitrageScanner AI

ArbitrageScanner AI suits retail crypto traders, professional analysts, and quant teams seeking real-time crypto arbitrage, sentiment, and on-chain data. It also supports market makers monitoring spreads, funds researching liquidity and wallet flows, bot developers needing actionable signals, and data teams that want to enrich internal dashboards via API. Educators and research desks can leverage its structured insights to explain market dynamics and validate trading hypotheses.

How to Use ArbitrageScanner AI

- Sign up on ArbitrageScanner.io and create your workspace.

- Choose how you’ll operate: web dashboard, Telegram bots, or both.

- Select exchanges, pairs, and DEX pools you want to monitor; optionally connect accounts for personalized tracking.

- Configure arbitrage rules: spread thresholds, fees, and slippage assumptions.

- Set up wallet analysis: add addresses, define labels, and enable movement alerts.

- Explore sentiment dashboards to track narratives, momentum, and risk signals.

- Enable Telegram alerts for real-time notifications and refine filters as needed.

- Validate signals and execute trades on your exchange; iterate settings to improve signal quality.

ArbitrageScanner AI Use Cases

Retail traders use the arbitrage scanner to identify cross-exchange spreads while factoring fees and slippage. Quant desks aggregate API data to build internal models and dashboards. Funds monitor wallet analysis to track whales, token unlocks, or treasury movements. Market makers watch DEX/CEX spreads to optimize routing. Token teams and researchers follow sentiment analysis to understand narrative shifts and plan communications or liquidity strategies.

ArbitrageScanner AI Pricing

ArbitrageScanner AI serves B2C users via its website and Telegram bots, and B2B clients via API access and software licenses with no maintenance costs. Pricing and plan details vary based on features, data access, and usage needs. For current packages or enterprise terms, consult the official site or contact sales.

Pros and Cons of ArbitrageScanner AI

Pros:

- Unified stack: arbitrage, sentiment, and on-chain data in one platform.

- Supports both CEX and DEX coverage for broader opportunity discovery.

- Cloud-based Telegram bots provide continuous monitoring and alerts.

- API and licensing options for seamless B2B integration.

- Educational materials and private client chat improve adoption and workflow.

Cons:

- Arbitrage outcomes can be limited by fees, latency, and liquidity conditions.

- Learning curve for users new to on-chain analytics or spread modeling.

- Exchange or network outages may affect data timeliness.

- Advanced features may require higher-tier plans.

- Signals do not eliminate market risk; disciplined execution is still required.

FAQs about ArbitrageScanner AI

-

Does ArbitrageScanner AI support decentralized exchanges?

Yes. It monitors both centralized and decentralized exchanges to help assess spreads and liquidity across venues.

-

Can I receive alerts via Telegram?

Yes. Personalized, cloud-based Telegram bots deliver real-time alerts based on your configured filters and thresholds.

-

Is there an API for developers and enterprises?

Yes. B2B users can access data and signals through an API and license the software with no maintenance costs.

-

Does the platform execute trades automatically?

It focuses on analysis, alerts, and workflow. Trade execution is handled on your chosen exchange or trading stack.

-

What can I track with wallet analysis?

You can follow specific addresses, token movements, and balance changes to identify trends and potential market impact.

-

Who is ArbitrageScanner AI best suited for?

Active traders, analysts, funds, and developers who need real-time arbitrage, sentiment, and on-chain intelligence.