Pionex

Open Website-

Tool Introduction:Pionex AI offers built-in crypto bots for 24/7 spot, futures, and earn.

-

Inclusion Date:Oct 21, 2025

-

Social Media & Email:

Tool Information

What is Pionex AI

Pionex AI is a cryptocurrency exchange built around in-house crypto trading bots. It enables 24/7 automated trading across spot and futures markets and offers structured earning products—without manual execution or coding. Using strategy templates and customizable parameters, you can automate entries, exits, and risk controls from a single interface. Real-time monitoring, order management, and portfolio tools help newcomers start quickly while giving experienced traders deeper control over execution and risk.

Pionex AI Main Features

- Built-in trading bots: Run ready-made strategies (e.g., grid-like and dollar-cost averaging styles) or customize parameters to match your risk tolerance and market view.

- Spot and futures automation: Apply bots on spot pairs or futures with options for take-profit, stop-loss, and position sizing to manage downside and lock in gains.

- Structured earning products: Access yield-oriented and market-condition strategies designed to complement active trading.

- 24/7 cloud execution: Strategies run on the exchange infrastructure—no VPS or local machine required.

- Order types and execution: Use exchange-grade order types (market, limit, stop) and manage positions from a unified dashboard.

- Portfolio tracking: Monitor P&L, allocations, and performance metrics with alerts to stay on top of risk.

- Security controls: Strengthen account protection with standard security practices such as two-factor authentication.

- Cross-platform access: Manage bots and orders via web and mobile for on-the-go oversight.

Pionex AI Ideal Users

Pionex AI suits beginners who want an accessible way to automate crypto trades, swing and day traders seeking hands-off execution, and long-term investors using recurring buys or rule-based entries. It also fits users looking to complement active strategies with structured earning products and those who prefer running bots directly on an exchange rather than managing external software.

Pionex AI How to Use

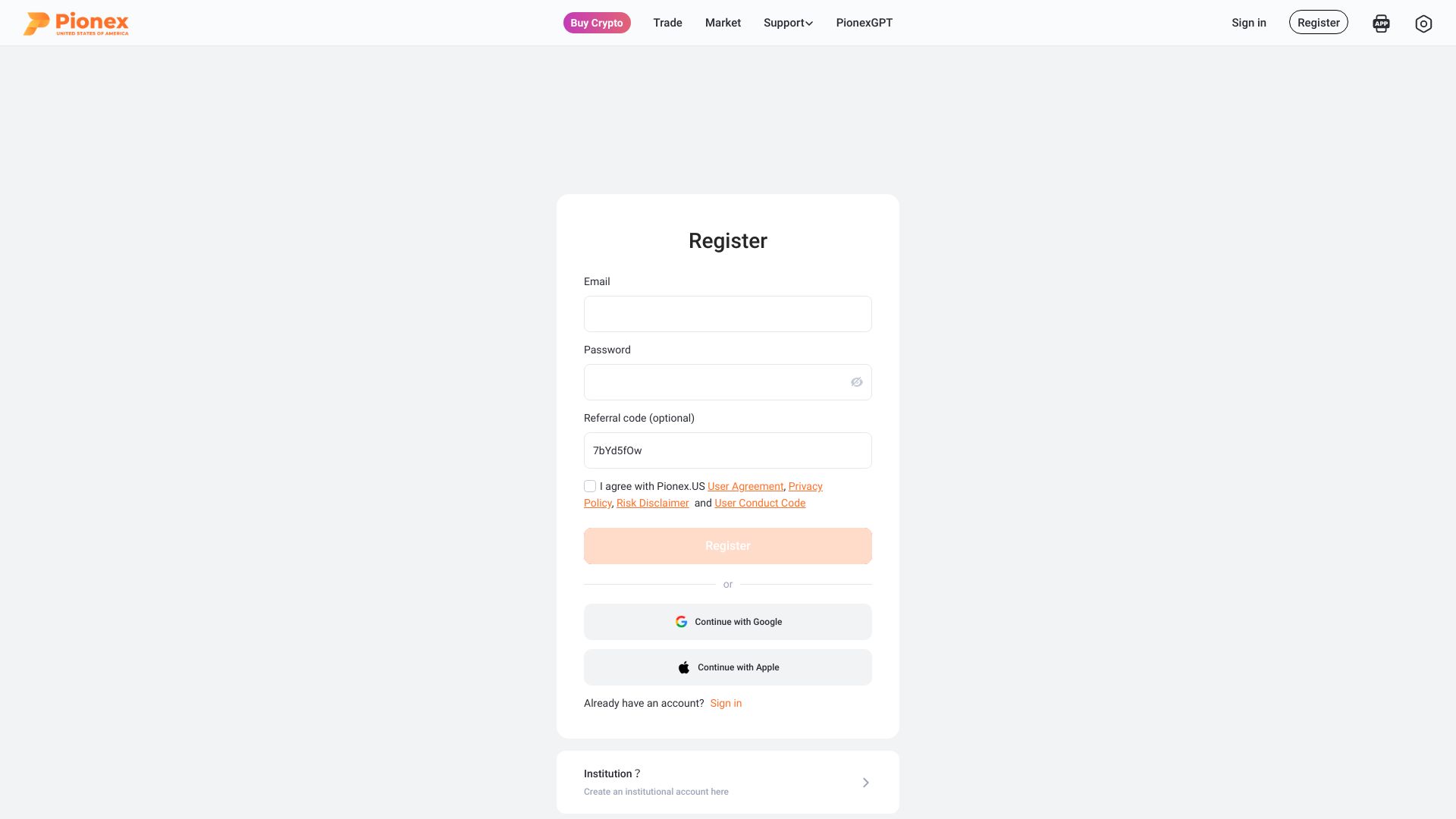

- Create an account and secure it with two-factor authentication.

- Complete identity verification if required by your region and product selection.

- Deposit or transfer funds/crypto to your exchange wallet.

- Choose a bot template or strategy style that fits your market outlook.

- Set parameters: trading pair, investment amount, risk controls (e.g., stop-loss/take-profit), and execution preferences.

- Start the strategy and monitor real-time metrics from the dashboard.

- Adjust parameters, pause, or close positions as market conditions change; withdraw funds when needed.

Pionex AI Industry Use Cases

Retail traders deploy automated strategies to capture range-bound volatility on spot markets without constant screen time. Active traders use futures automation to define entries, exits, and risk limits for consistent execution. Asset holders complement their core positions with structured earning products to seek yield on idle balances while maintaining liquidity and oversight.

Pionex AI Pricing

Pionex AI typically follows an exchange-based fee model, where standard trading fees apply to executed orders. The built-in bots are integrated with the platform, so there is generally no separate software subscription for automation. Fees and funding rates may vary by market (spot vs. futures) and product type; check the official fee schedule for current rates and any regional terms. Promotions or trials may be offered periodically.

Pionex AI Pros and Cons

Pros:

- Integrated automated trading with no coding required.

- Supports both spot and futures in one environment.

- Templates lower the learning curve; parameters allow granular control.

- Cloud execution enables 24/7 operation without extra infrastructure.

- Unified monitoring, alerts, and portfolio analytics.

Cons:

- Crypto markets are volatile; automated strategies can underperform in sharp trend or illiquid conditions.

- Parameter tuning has a learning curve and may lead to over-optimization.

- Exchange lock-in—strategies run within this platform’s markets and liquidity.

- Regional availability, KYC, and product access can vary by jurisdiction.

- Trading fees and futures funding rates can impact net returns.

Pionex AI FAQs

-

Do I need coding skills to use Pionex AI?

No. The platform provides built-in bots and strategy templates that you configure through a visual interface.

-

Can the bots run 24/7 without my computer?

Yes. Strategies execute on the exchange’s infrastructure, so they continue running even when you are offline.

-

What assets can I trade with Pionex AI?

A wide range of cryptocurrency pairs is supported across spot and, where available, futures markets. Specific availability may depend on your region.

-

How do I manage risk when using bots?

Set position sizing, stop-loss and take-profit rules, define max drawdown thresholds, and review performance regularly before allocating more capital.

-

Can I stop a bot and withdraw funds at any time?

You can pause or close strategies from the dashboard and then withdraw available balances, subject to network conditions and account verification requirements.