- Home

- AI For Finance

- Moning

Moning

Open Website-

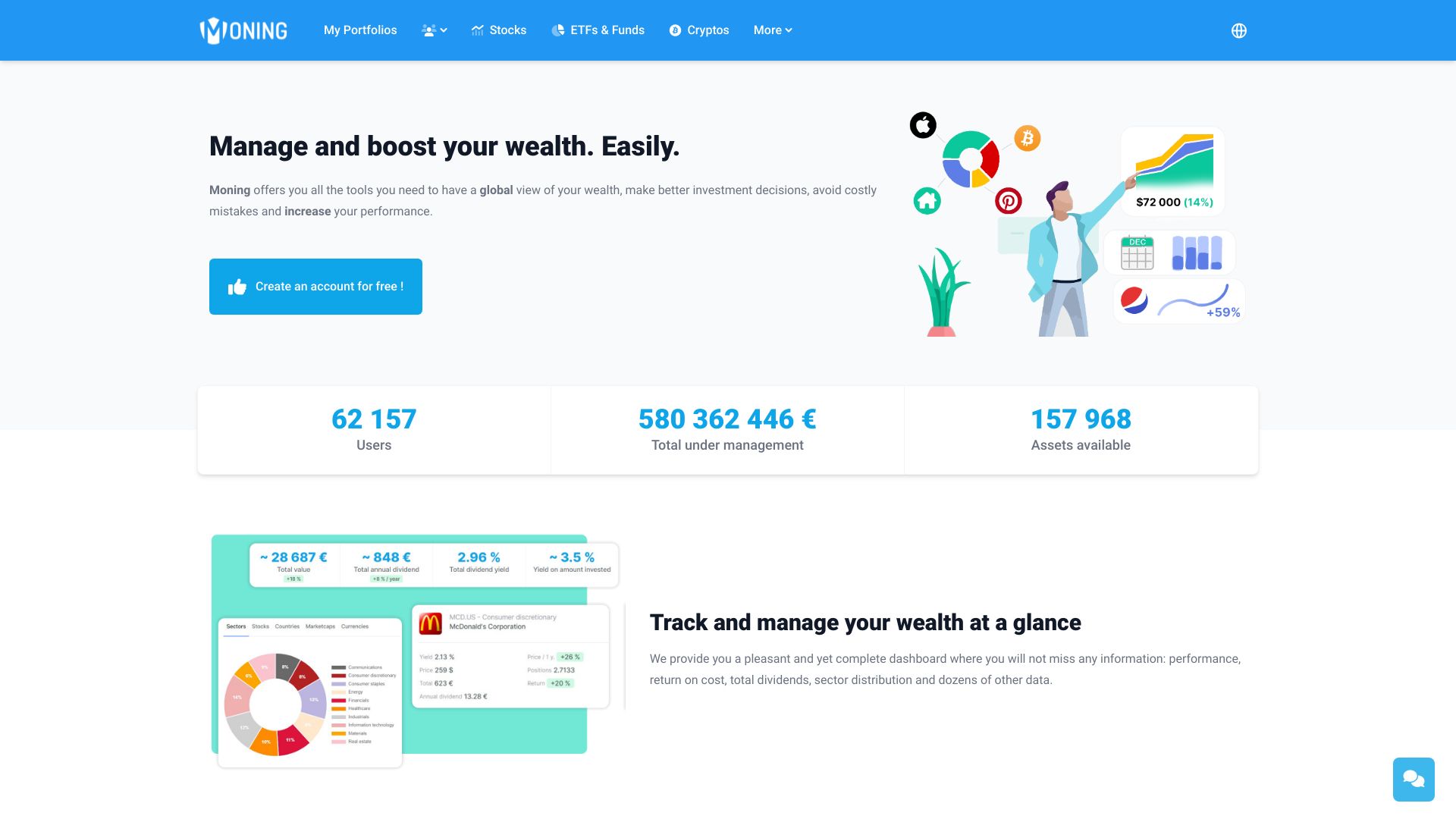

Tool Introduction:AI portfolio tracker with dividend forecasts and risk scores.

-

Inclusion Date:Oct 28, 2025

-

Social Media & Email:

Tool Information

What is Moning AI

Moning AI is an all-in-one wealth platform that centralizes your investments across stocks, ETFs, and cryptocurrencies. It combines a clear portfolio overview with AI-driven analysis and safety scores to highlight risk and quality signals. With dividend forecasting, performance tracking, and multi-asset insights, Moning AI helps you anticipate income, compare opportunities, and avoid costly mistakes. By turning market data into actionable guidance, it supports more confident, data-driven decisions and a global, up-to-date view of your overall wealth.

Moning AI Main Features

- Unified portfolio tracking: See stocks, ETFs, and crypto in one dashboard for a complete wealth snapshot.

- AI analysis and safety scores: Assess risk, stability, and asset quality quickly to inform decisions.

- Dividend calendar and forecasting: Anticipate upcoming payouts and plan cash flows more effectively.

- Performance and allocation analytics: Monitor returns, diversification, and exposure across sectors and asset classes.

- Multi-asset comparisons: Evaluate alternatives side by side to reduce bias and avoid concentration.

- Clear visual insights: Transform raw data into understandable charts and summaries that guide next steps.

Who Should Use Moning AI

Moning AI suits individual investors who want a clean, consolidated portfolio tracker with AI insights. It is especially helpful for dividend-focused investors planning income, ETF allocators seeking balance and diversification, and crypto holders who want their digital assets monitored alongside traditional securities. Investment clubs and self-directed investors can also use it to compare ideas and improve decision quality.

How to Use Moning AI

- Create an account and set your base currency and preferences.

- Add holdings across stocks, ETFs, and crypto to build your portfolio overview.

- Organize positions into portfolios and watchlists to mirror your real accounts.

- Review AI analysis and safety scores for assets you own or are considering.

- Check the dividend calendar and forecasts to plan expected income.

- Explore allocation and performance analytics to identify concentration and gaps.

- Compare alternatives side by side and refine your strategy before making decisions.

- Return to the dashboard regularly to track changes and adjust allocations as needed.

Moning AI Industry Use Cases

An individual investor consolidates multiple brokerage and crypto holdings, uses AI safety scores to rebalance away from high-risk names, and plans quarterly income with the dividend forecast. A dividend-focused investor screens holdings by payout stability and coverage, then builds a calendar to smooth cash flows. A passive ETF allocator compares regional and sector ETFs to improve diversification while keeping fees and overlap in check.

Moning AI Pros and Cons

Pros:

- All-in-one view across stocks, ETFs, and crypto in a single wealth management dashboard.

- AI analysis and safety scores support risk-aware, evidence-based decisions.

- Dividend forecasting helps plan and smooth investment income.

- Clear performance and allocation analytics aid diversification and oversight.

- Side-by-side comparisons reduce bias and help avoid costly mistakes.

Cons:

- AI scores are models and cannot capture every market event or idiosyncratic risk.

- Not a substitute for independent research or professional financial advice.

- Data freshness and coverage may vary by market and asset type.

- Insights depend on the completeness and accuracy of your inputted holdings.

Moning AI FAQs

-

Does Moning AI replace my broker?

No. Moning AI is a portfolio analytics and tracking platform; you place trades through your brokerage or exchange.

-

What assets can I track with Moning AI?

You can track a mix of stocks, ETFs, and cryptocurrencies to maintain a unified view of your wealth.

-

How should I use safety scores?

Treat them as an additional risk and quality signal to complement, not replace, your own research and judgment.

-

Can Moning AI forecast dividends?

Yes. Its dividend calendar and forecasting tools help you anticipate upcoming payouts and plan cash flows.

-

Is Moning AI suitable for long-term investors?

Yes. Long-term and dividend-focused investors can use its analytics to monitor allocations, income, and portfolio health over time.