- Home

- AI Tax Assistant

- TaxTim

TaxTim

Open Website-

Tool Introduction:South African tax assistant with SARS eFiling guidance, maximize refunds.

-

Inclusion Date:Oct 21, 2025

-

Social Media & Email:

Tool Information

What is TaxTim AI

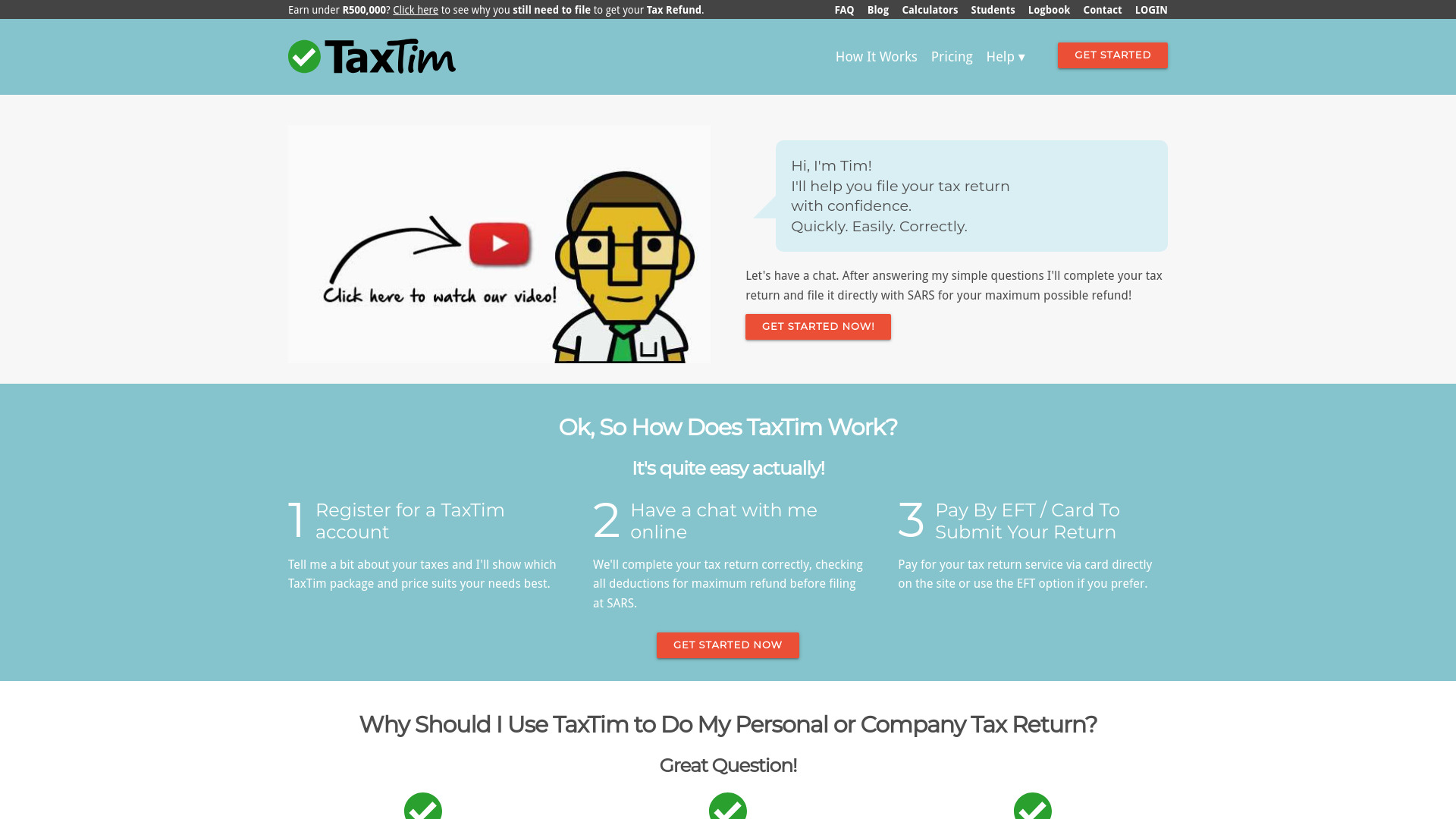

TaxTim AI is an online tax assistant built to help South Africans complete accurate tax returns with less effort. Using a friendly, step-by-step questionnaire, it gathers your income, deductions, and credits in plain language and structures them for SARS compliance. With seamless SARS eFiling integration, it streamlines preparation and submission, reduces common mistakes, and highlights eligible deductions to help maximize refunds. TaxTim AI supports salaried individuals, provisional taxpayers, independent contractors, and small businesses seeking clear, guided tax filing.

TaxTim AI Main Features

- Guided questionnaire: Plain-language prompts tailored to South African tax rules capture all relevant income and deductions.

- SARS eFiling integration: Prepare your return and submit via your SARS eFiling profile for a seamless filing workflow.

- Smart validation checks: Flags missing data and inconsistencies to reduce errors and rework.

- Deduction discovery: Contextual tips for common deductions (e.g., medical, retirement, travel, home office) to help maximize refunds.

- Supports multiple income types: Salary, freelance/contracting, rental, and business income for provisional taxpayers.

- Auto calculations: Estimates tax due or refund based on your inputs before submission.

- Document checklist: Guidance on records like salary certificates (IRP5) and expense proofs to stay compliant.

Who Should Use TaxTim AI

TaxTim AI is ideal for South African taxpayers who want a clear, step-by-step way to file: salaried employees with straightforward returns, provisional taxpayers with multiple income streams, independent contractors and freelancers tracking expenses, and small business owners or sole proprietors who need practical guidance to stay SARS-compliant.

How to Use TaxTim AI

- Create an account and select your taxpayer profile (salaried, provisional, contractor, or small business).

- Answer the guided questions about income, expenses, dependants, and deductions in plain language.

- Review the auto-calculated summary of taxable income and your estimated refund or amount due.

- Address any validation flags and prepare supporting documents as prompted.

- Connect to SARS eFiling and submit your completed return through your profile.

- Save your confirmation and keep records for your compliance file.

TaxTim AI Industry Use Cases

A salaried professional uses TaxTim AI to capture salary certificate details and medical aid contributions, reducing errors and finishing a standard return quickly. A freelance designer records project income and deductible expenses, then files as a provisional taxpayer with confidence. A sole proprietor tracks mixed income and home office costs, using the tool’s prompts to surface legitimate deductions. A landlord adds rental income and property expenses for a compliant, complete return.

TaxTim AI Pros and Cons

Pros:

- Localized guidance for South African tax law and SARS processes.

- Direct integration with SARS eFiling for streamlined submission.

- Plain-language, step-by-step workflow that reduces filing mistakes.

- Helpful prompts to identify eligible deductions and credits.

- Suitable for both simple and more complex returns (e.g., provisional taxpayers).

Cons:

- Focused on South African taxpayers; not relevant outside SA.

- Outcomes depend on accurate user input and supporting documents.

- Very complex scenarios may still require a registered tax practitioner.

- Submission timing can be affected by SARS eFiling availability.

TaxTim AI FAQs

-

Does TaxTim AI integrate with SARS eFiling?

Yes. TaxTim AI integrates with SARS eFiling so you can prepare and submit your return using your SARS profile.

-

Who can use TaxTim AI?

Salaried individuals, provisional taxpayers, independent contractors, and small businesses in South Africa.

-

Can it help with provisional tax?

Yes. It supports provisional taxpayers, guiding you through multiple income sources and relevant calculations.

-

Will it maximize my tax refund?

It highlights eligible deductions and credits based on your inputs. Your final refund depends on your specific tax profile and documentation.

-

Do I still need a tax practitioner?

Many users can file on their own with TaxTim AI. For highly complex cases, consulting a registered practitioner may be advisable.